- The Money Maniac

- Posts

- 💰 Welcome To The SaaSpocalypse

💰 Welcome To The SaaSpocalypse

Until recently, AI was sold as a copilot. A helper that made employees faster. You still needed the human. You still needed the software seat. That framing just broke.

Good morning, Maniacs!

It’s Super Bowl week, and the prediction markets have spoken.

Bettors are giving the Seahawks a 69% edge, with Sam Darnold enjoying 44% MVP odds. Confidence is high in Seattle.

Markets, meanwhile, are sending mixed signals.

Walmart joined the $1 trillion club, IPO calendars are filling up fast, and Amazon rattled nerves with a jaw-dropping $200B capex forecast.

But the real action is elsewhere.

Software stocks are getting smoked, even after beating earnings. AI is no longer a toy, and Wall Street is starting to question which platforms deserve a seat at the table in an automated world.

Let’s dive in! 👇

OUR PARTNER: CARTI

You’re Leaving Money On The Table 💸

Most Shopify stores see shoppers drop off right before checkout. Not because of price, but because of unanswered questions.

Carti fixes this. It’s a 24/7 AI shopping assistant that turns browsers into buyers.

Carti answers questions instantly, recommends the right items, recovers hesitant carts, and nudges shoppers toward checkout automatically.

Set up in 5 minutes.

No tickets. No waiting. No code.

Just more conversions, higher AOV, and fewer missed sales.

If you want to monetize your Shopify traffic without hiring more support or spending more on ads, Carti does the selling for you — day and night.

THE MAIN EVENT

Welcome To The SaaSpocalypse 🧨

Software stocks are having a moment, and not the fun kind.

Tech is the worst-performing sector in the S&P 500 this year, and software is leading the slide. The iShares Tech-Software ETF ($IGV) is down 26% year-to-date, putting it firmly in “uh-oh” territory.

This isn’t just one or two weak names. It’s a broad-based sell-off:

Asana ($ASAN): -38%

Intuit ($INTU): -34%

Oracle ($ORCL): -30%

Salesforce ($CRM): -28%

Adobe ($ADBE): -23%

LegalZoom ($LZ): -21%

Microsoft ($MSFT): -18%

The scary part? Many of these companies beat earnings.

So what’s going on?

From Copilot to Coworker

Until recently, AI was sold as a copilot. A helper that made employees faster. You still needed the human. You still needed the software seat.

That framing just broke.

Last week, Anthropic rolled out Claude Cowork and a suite of agentic plugins. These are tools that don’t just assist, but do the work end-to-end. Think less “help me draft” and more “handle this entire task.”

One example that rattled investors:

Claude’s Legal Plugin can independently review NDAs, flag risky clauses, and draft legal strategies.

That sent stocks like LegalZoom, Thomson Reuters, and RELX tumbling by double digits.

The takeaway was jarring: if a $100/month AI agent can replace expensive legal or research software seats, why keep paying the middleman?

The SaaS Math Problem

This shift creates two big problems for traditional software companies:

More competition, faster

AI lowers the barrier to building custom tools. Markets that once supported a few dominant platforms could fragment quickly as niche, AI-powered alternatives pop up.Per-seat pricing breaks

SaaS has long relied on “land and expand.” Get a customer in the door, then grow revenue as they hire more people. AI flips that logic. Companies are becoming more efficient, not larger. If one AI agent replaces the work of three employees, the customer needs fewer software seats. Revenue shrinks even as productivity improves.

That fear is already showing up in the tape.

Short sellers have reportedly made $24 billion betting against software stocks this year, as the sector’s market value has dropped by roughly $1 trillion.

And this anxiety is not limited to office software.

The same concerns spilled into video game developers, where investors started worrying that AI could eventually automate parts of game creation itself.

As soon as Google debuted Project Genie, an AI-powered tool that generates playable game worlds, markets jumped to conclusions.

Unity ($U) plunged 24%

Roblox ($RBLX) fell 13%

Take-Two ($TTWO) dropped 8%

Genie is nowhere near replacing these game engines today, but markets priced the direction anyway.

Rotation, Not Collapse

As money exits tech, it is not disappearing. It is rotating into the stable, boring stuff.

The S&P 500 consumer staples sector is up nearly 12% YTD, second only to energy. Predictable cash flows are beating futuristic promises.

The Big Picture

This isn’t the end of software. But it is a reset.

Investors are being forced to ask harder questions:

Which software benefits as AI improves?

Which gets quietly displaced?

Which platforms are indispensable, and which are just expensive glue?

The SaaSpocalypse isn’t about earnings today. It’s about who still gets paid tomorrow.

Where are you placing your bets? |

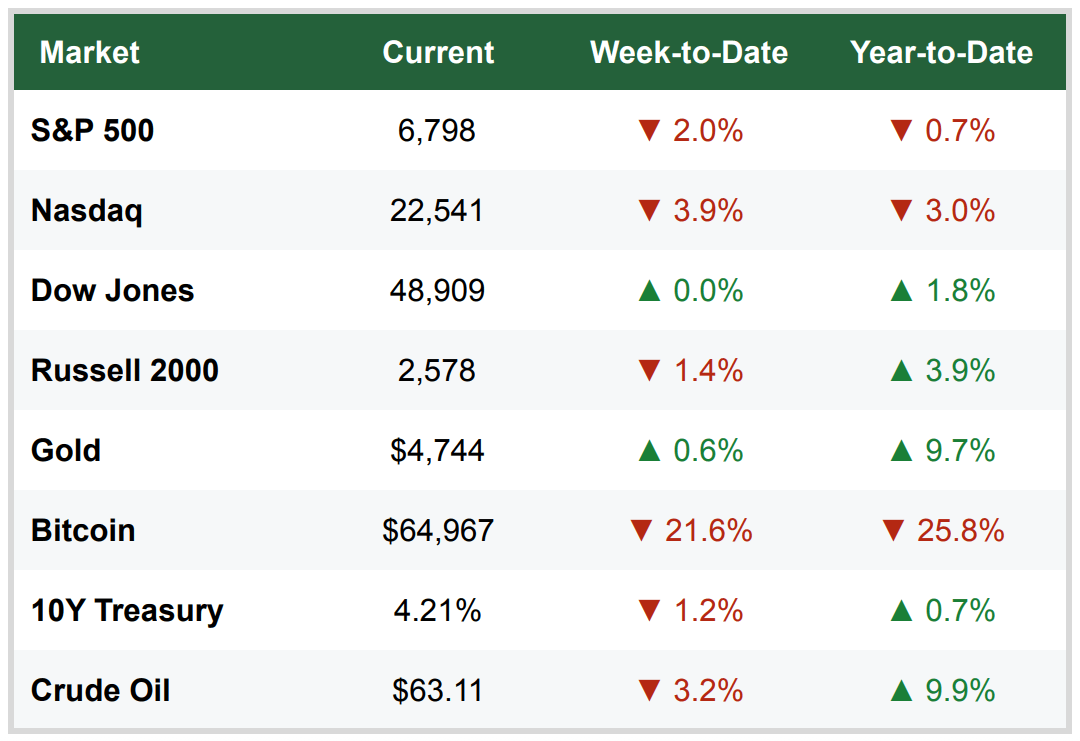

MARKET MOOD

S&P Flips Red On The Year, Bitcoin Cracks 🤕

Winners

DaVita ($DVA) - Market Cap: $10.0B (Week-to-Date: +36.5%)

DaVita, a Berkshire-backed stock, ripped higher after beating earnings and revenue expectations and proving its Integrated Kidney Care program is now profitable. A new home-care partnership helped seal the deal.

McKesson ($MCK) - Market Cap: $119.1B (Week-to-Date: +15.2%)

McKesson delivered a strong quarter, posting double-digit revenue and profit growth and raising full-year guidance. Expansion across oncology and biopharma services helped, while progress toward spinning off its medical-surgical unit added fuel to the rally.

FedEx ($FDX) - Market Cap: $85.9B (Week-to-Date: +12.9%)

FedEx caught a bid after unveiling plans for a massive expansion of its Memphis air hub. The proposed five-story, 1.6M sq. ft. sort center is all about keeping up with e-commerce demand, and investors liked the long-term growth signal.

Losers

Coinbase ($COIN): -25.0% | Robinhood ($HOOD): -26.9% | Strategy ($MSTR): -28.5%

Crypto-linked stocks sank as Bitcoin slid sharply toward $60K, dragging the whole ecosystem down with it. The sudden decline wasn’t kind to exchanges, brokers, or big corporate holders.

Advanced Micro Devices ($AMD) – Market Cap: $313.4B (Week-to-Date: -18.7%)

AMD didn’t disappoint — it just didn’t impress enough. Despite solid earnings, Morgan Stanley trimmed its price target, sparking the stock’s worst day in over eight years. In this market, anything less than perfect gets punished.

Estée Lauder ($EL) – Market Cap: $34.8B (Week-to-Date: -16.2%)

Estée Lauder beat adjusted earnings estimates, but the win got buried under restructuring charges and tariff costs. Management pointed to early signs of improvement, especially in China, but investors focused on the margin pain instead.

OUR PARTNER: CARTI

The Checkout Leak You’re Not Seeing 📉

You design great products, drive traffic, and run promotions. Don’t drop the ball at the finish line.

Carti plugs your checkout leak by answering questions, removing friction, and guiding visitors to purchase. It turns high-intent shoppers into incremental revenue.

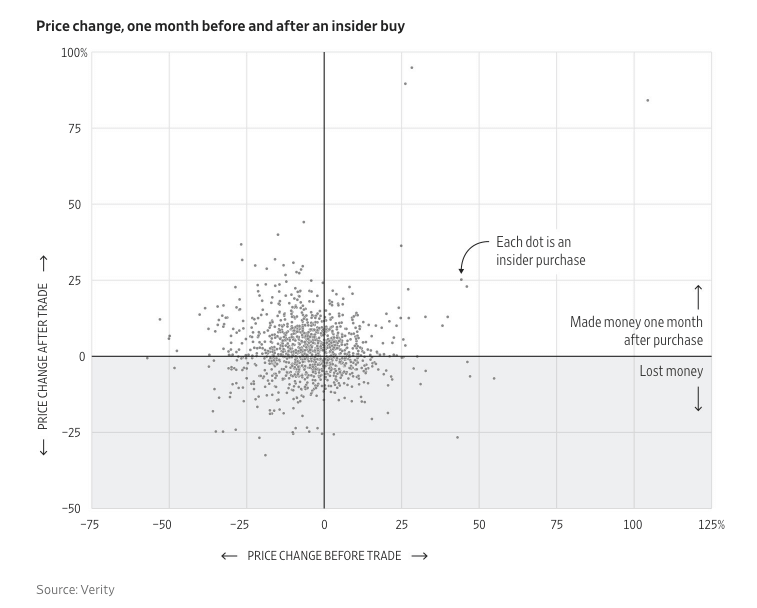

CHART OF THE WEEK

Do Insider Buys Actually Signal A Bounce? 👀

Insider buying tends to happen after stocks fall. A study of 1,400 insider purchases revealed that roughly 69% occurred following a negative one-month return.

Most stocks did rise, with a median gain of ~2% in the month after purchase

But the boost was short-lived: only 15% fully recovered their prior month losses

Miss the initial pop, and there’s little excess return

Bottom line: insider buys often signal a near-term bounce, not a lasting edge. The signal fades fast.

FAST FACTS

IPOs Pop, Snacks Drop, and BTC Flops 🥨

🚀 Biggest IPO week in 5 years: From biotech to Jennifer Garner’s baby food brand, eight $100M+ IPOs launched this week. [Read]

🥤 Pepsi slashes snack prices: Just one month after the USDA let states restrict sugary SNAP purchases, Pepsi cut prices up to 15%. [Read]

📉 BTC down 46% from highs: If history repeats, the bottom may be another 260 days away, pointing to a potential floor in October. [Read]

🌍 U.S. eyes $12B Africa deal: Trump plans to build a critical minerals stockpile, with the DRC as a key partner. It’d be the biggest U.S. investment in Africa in a decade. [Read]

🛒 Walmart joins the $1T club: It took 62 years to hit $500B in value, and just two more to double it. Now, the retailer joins elite territory once reserved for Big Tech. [Read]

🏭 Manufacturing roars back: The ISM PMI hit 52.6, its highest reading since 2022, finally breaking out of contraction territory. [Read]

🇺🇸 Warsh wins the Fed seat: Trump tapped ex-Fed governor Kevin Warsh to lead the central bank. The decision sent the dollar higher and precious metals lower. [Read]

📡 Ford wants your ears and eyes: The carmaker filed patents for ad tech that watches billboards and listens to in-car convos. Personalized ads could be coming to a dashboard near you. [Read]

📰 Bezos trims the Post: The Washington Post cut 1/3 of its staff and gutted entire sections, including sports and local news. Critics say it’s profit over journalism, Bezos says it’s survival mode. [Read]

WORDS TO REMEMBER

If Investing Feels Exciting, You’re Doing It Wrong 🧠

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

MENTIONS: $ORCL ( ▲ 1.2% ) $CRM ( ▲ 3.41% ) $ADBE ( ▲ 1.04% ) $MSFT ( ▲ 2.99% ) $LZ ( ▲ 2.5% )

Reply