- The Money Maniac

- Posts

- 💰 Wall Street Signals Confidence For 2026

💰 Wall Street Signals Confidence For 2026

Major banks and research shops see the S&P 500 finishing 2026 somewhere between 7,100 and 8,100, with the median forecast landing at 7,700. That implies a 12.5% gain from today’s levels.

Good morning, Maniacs!

I hope you had a great holiday break and are feeling recharged for the year ahead.

It’s a quiet week with no major earnings reports, which makes this the perfect time to step back and see how Wall Street is thinking about 2026.

Before we begin, please take a minute to complete the short survey below.

It only takes two minutes to submit your picks. I’ll highlight great calls throughout the year, and one reader will be named THE Money Maniac of 2026.

P.S. — I’m kicking off 2026 with a slightly refreshed format. The newsletter is slimmer, with fewer sections and one deeper dive. I’ll be testing this setup for a few weeks, and I’d love to hear what you think.

Let’s dive in. 👇

THE MAIN EVENT

Wall Street Signals Confidence For 2026 📈

Wall Street has officially weighed in on 2026, and the verdict is bullish.

Right now, major banks and research shops see the S&P 500 finishing 2026 somewhere between 7,100 and 8,100, with the median forecast landing at 7,700. That implies a 12.5% gain from today’s levels, an above-average year by historical standards.

And that’s notable, considering the market has already logged three straight strong years. In fact, the last time the S&P 500 pulled off four consecutive annual gains was 2003-2007.

So what should investors actually do with these targets?

Focus less on the number and more on the message. Think of them as a compass, not a GPS — that’s how RBC strategist Lori Calvasina frames it.

These targets aren’t meant to tell you exactly where the market will land, just which direction strategists believe it’s headed.

And directionally? Wall Street is pointing north.

Institution | 2026 Year-End Target | Implied Return |

|---|---|---|

Oppenheimer | 8,100 | +18.3% |

Deutsche Bank | 8,000 | +16.9% |

Morgan Stanley | 7,800 | +13.9% |

Evercore | 7,750 | +13.2% |

RBC | 7,750 | +13.2% |

Citi | 7,700 | +12.5% |

FundStrat | 7,700 | +12.5% |

UBS | 7,700 | +12.5% |

Yardeni Research | 7,700 | +12.5% |

Goldman Sachs | 7,600 | +11.0% |

J.P. Morgan | 7,500 | +9.6% |

Wells Fargo | 7,500 | +9.6% |

Barclays | 7,400 | +8.1% |

LPL Financial | 7,350 | +7.4% |

Bank of America | 7,100 | +3.7% |

Forecasts Are Almost Always Wrong (Yet Still Useful)

A few truths worth keeping in mind:

1. Average years are rare

Since 1950, the S&P 500 has delivered an 8-10% return just four times. Most years are far more dramatic, either much better or much worse.

2. The range of “normal” is massive

The market return’s standard deviation is ±20 percentage points. In other words, a year anywhere from -10% to +30% is considered totally normal.

3. Strategists hate being singled out

Markets rise roughly 70% of the time, and calling for a bad year can be a career-limiting move. So instead of sticking their necks out, many strategists cluster around the “safe” average — which is often wrong, but rarely embarrassing.

In fact, one major firm recently waved the white flag entirely.

Piper Sandler’s Michael Kantrowitz ditched year-end S&P 500 targets altogether, calling them “an extremely poor form of insight.”

Translation: even the pros know the exact number isn’t the point.

Why Is Wall Street Bullish Anyway?

Optimism isn’t coming out of thin air. Three big themes keep popping up:

1. Profits are still growing

Earnings and margins are moving in the right direction, and that’s what ultimately drives stock prices.

Analysts anticipate 14% earnings growth in 2026

Growth is expected to broaden beyond just the Magnificent Seven

AI, automation, and leaner operations are boosting efficiency

That’s why 2026 is increasingly being called the “AI show-me year.” Investors don’t want more hype. They want proof that AI actually improves productivity.

2. Consumers and businesses should have more cash

Policy changes are expected to put more money back into the system.

Many households are likely to see larger tax refunds, and potential rebate checks could add to consumer spending

Businesses can now deduct 100% of equipment purchases upfront, encouraging more investment

Historically, similar policies have led to higher capital spending and faster growth.

3. Policy isn’t fighting the market

Monetary (interest rate) and fiscal (tax) policy both appear supportive.

The Fed is expected to keep cutting rates toward 3.0–3.25%

Corporate tax cuts could reduce bills by $129B through 2027

Fiscal stimulus could add nearly 1% to GDP

In short: profits are growing, cash is flowing, and policy looks more like a tailwind than a headwind.

But Don’t Ignore the Yellow Flags 🚧

No one’s calling for a crash, but some risks remain:

Inflation is still hovering near 3%

Labor markets are cooling

Valuations remain elevated, especially in tech

Midterm election years are historically the weakest of the four-year cycle, with the lowest average returns and win rates

Volatility wouldn’t be surprising.

The Real Takeaway for Investors

Market targets can create a false sense of precision. Don’t anchor to 7,700 vs. 7,500 vs. 8,100. Those differences are mostly noise.

Instead:

Recognize that most of Wall Street is bullish

Remember that earnings drive stocks, and earnings expectations are solid

Accept that market gyrations are fickle, emotional, and impossible to time

Plus, even the most cautious forecast — Bank of America’s 7,100 — still assumes continued earnings growth. That outlook simply calls for valuations to come down (i.e., lower P/E multiples).

That’s not bearish — that’s a reset. And for long-term investors still deploying cash? It’s actually a pretty healthy outcome.

There’s no telling exactly what this year brings. But here’s to playing the long game in 2026. 🚀

OUR PARTNER: GOOGLE ADSENSE

Banish bad ads for good

Your site, your ad choices.

Don’t let intrusive ads ruin the experience for the audience you've worked hard to build.

With Google AdSense, you can ensure only the ads you want appear on your site, making it the strongest and most compelling option.

Don’t just take our word for it. DIY Eule, one of Germany’s largest sewing content creators says, “With Google AdSense, I can customize the placement, amount, and layout of ads on my site.”

Google AdSense gives you full control to customize exactly where you want ads—and where you don't. Use the powerful controls to designate ad-free zones, ensuring a positive user experience.

MARKET MOOD

Stocks Cool Off After Another Hot Year 🌡️

Winners

Nike ($NKE) – Market Cap: $94.2B (5-day move: +11.1%)

Nike jumped after heavy insider buying, including a $1M+ purchase by CEO Elliott Hill and a $3M buy from board member Tim Cook. The moves signal confidence in the sportswear brand’s turnaround strategy.

Molina Healthcare ($MOH) – Market Cap: $9.4B (5-day move: +5.8%)

Molina climbed after Michael Burry called it a potential 2026 takeover target. The shoutout reignited interest in the beaten-down managed care stock despite a tough year for healthcare names.

Losers

CoreWeave ($CRWV) – Market Cap: $35.7B (5-day move: -10.8%)

CoreWeave slid on AI bubble fears, with investors uneasy about high debt, thin margins, and delayed data center builds. The stock remains expensive from a price-to-sales perspective, especially after an 84% run since its IPO in March.

Tesla ($TSLA) – Market Cap: $1.50T (5-day move: -7.4%)

Tesla fell after warning of a Q4 delivery decline of roughly 15% year over year. The EV-maker cited weaker demand following the EV tax credit loss and intensifying competition.

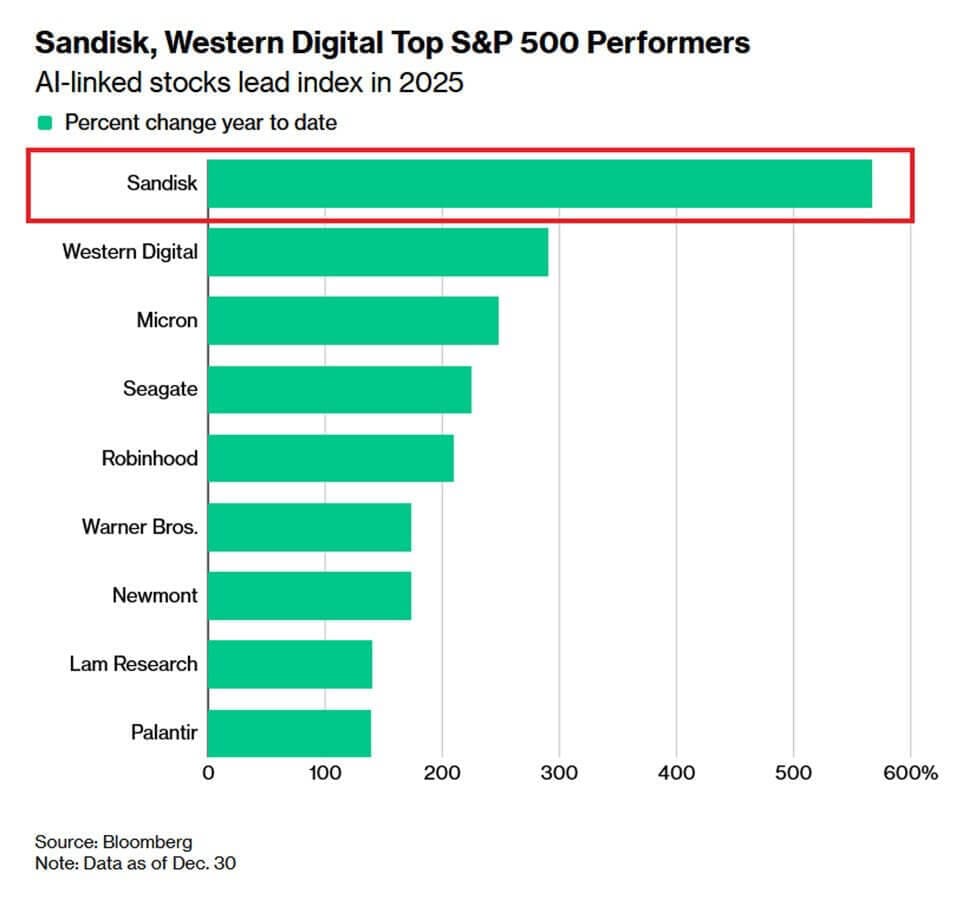

CHART OF THE WEEK

Where The Market’s Real Momentum Lives 📊

The S&P 500 closed 2025 up 16%, fueled by AI spending. The real winners were data storage and data-center plays, not just chips.

The losers? Consumer staples, retail, and healthcare as tariffs landed and lower-income households pulled back.

OUR PARTNER: GOOGLE ADSENSE

Easy setup, easy money

Your time is better spent creating content, not managing ad campaigns. Google AdSense's automatic ad placement and optimization handles the heavy lifting for you, ensuring the highest-paying, most relevant ads appear on your site.

FAST FACTS

From Science Leaps To Safer Streets ⚡

🧠 AI accelerates scientific breakthroughs: From Alzheimer’s detection to weather forecasting, AI-powered tools drove major discoveries in 2025. [Read]

📈 2026 economic outlook improves: Bigger tax refunds, full equipment write-offs, and lower rates are giving economists optimism heading into next year. [Read]

💊 Wegovy goes needle-free: Novo Nordisk won U.S. approval for the first GLP-1 weight-loss drug in pill form, opening the door for needle-free treatment and a much wider patient audience. [Read]

🏙️ Luxury apartments are pushing rents down: New high-end supply is pulling wealthy tenants upward, forcing landlords to slash prices on older units. Rents in some cities fell as much as 11%. [Read]

💉 Big Pharma cuts drug prices: Pfizer, Eli Lilly, Novo Nordisk, and 6 other drug companies struck deals with Trump to lower prices in exchange for tariff relief. [Read]

🧾 Berkshire CEO faces $358B test: With Warren Buffett officially stepping aside, investors are watching how new CEO Greg Abel will deploy Berkshire’s massive cash pile. [Read]

🚨 Crime rates plunge nationwide: U.S. murders are on pace for the largest one-year drop ever, down nearly 20%, alongside declines in robbery, auto theft, and aggravated assault. [Read]

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

MENTIONS: $NKE ( ▼ 0.32% ) $MOH ( ▲ 1.86% ) $CRWV ( ▼ 8.12% ) $TSLA ( ▲ 0.03% )

Reply