- The Money Maniac

- Posts

- 💰 The Small Cap King Is Back

💰 The Small Cap King Is Back

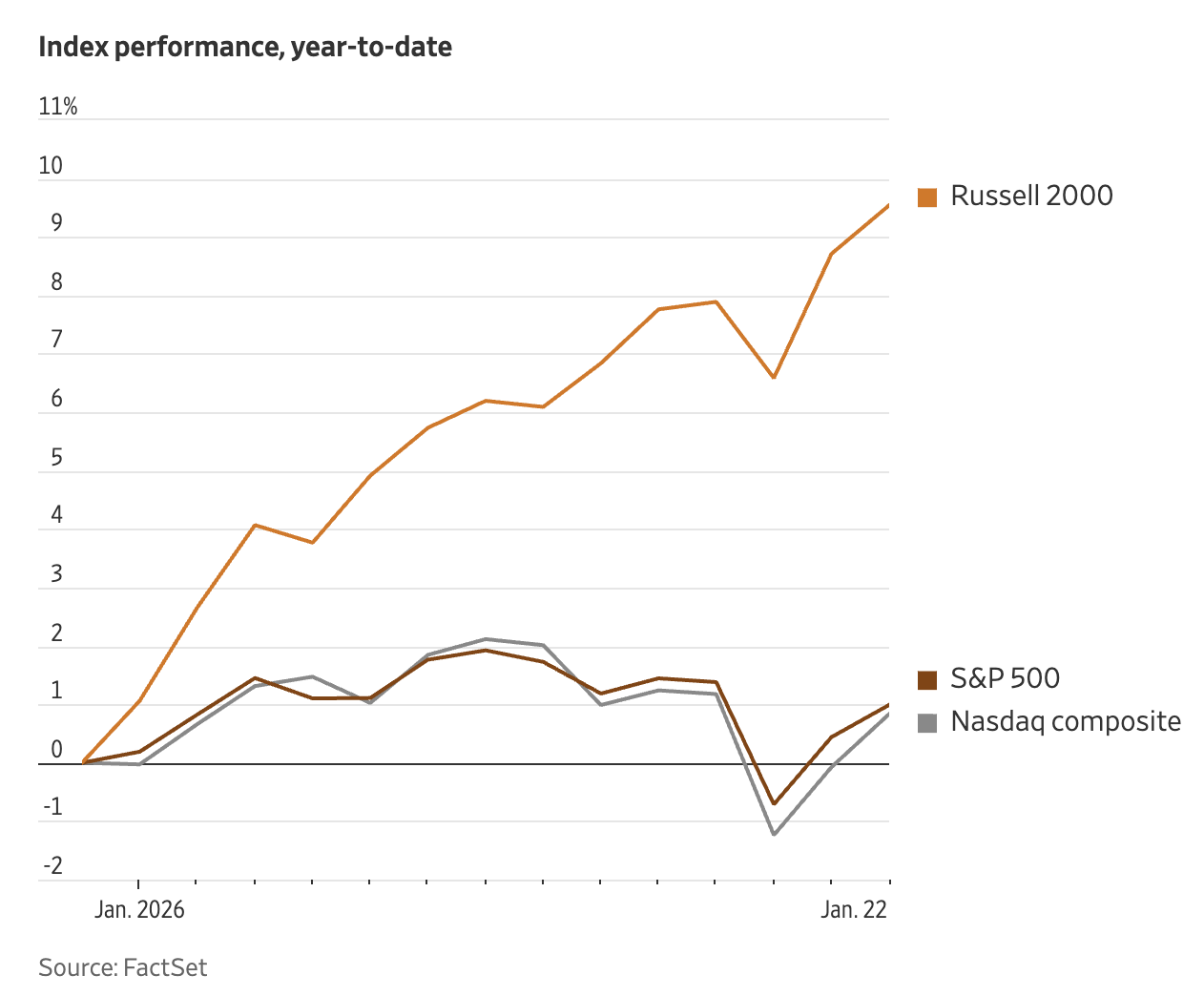

The Russell 2000 has now beaten the S&P 500 for 14 straight sessions, its longest winning streak over large caps since May 1996.

Good morning, Maniacs!

The U.S. economy just flashed a big green light. Q3 GDP was revised up to 4.4%, the strongest growth in two years. Meanwhile, inflation refuses to behave, with core PCE holding at 2.8%.

World leaders and CEOs spent the week rubbing elbows in Davos. Trump sent markets on a brief Greenland detour before landing us right back where we started. One asset, however, kept winning through all the noise: gold.

Last week, I asked whether I should chase the gold rally. The vote was pretty split, with 40% of you saying “wait for the pullback.” Gold responded “what’s that?”, jumped 8%, and kept charging toward $5,000.

Today, we’re breaking down a notable shift in market leadership, why gene editing is starting to turn into real revenue, how billionaires are positioning for 2026, and where to grab a free $400.

Let’s dive in! 👇

OUR PARTNER: WISPR FLOW

Fast, accurate financial writeups

When accuracy matters, typing can introduce errors and slow you down. Wispr Flow captures your spoken thinking and turns it into formatted, number-ready text for reports, investor notes, and executive briefings. It cleans filler words, enforces clear lists, and keeps your voice professional. Use voice snippets for standard financial lines, recurring commentary, or compliance-ready summaries. Works on Mac, Windows, and iPhone. Try Wispr Flow for finance.

THE MAIN EVENT

Small Caps Finally Get Their Moment 🐜📈

For the first time in a long time, the small-cap king is back.

The Russell 2000 has now beaten the S&P 500 for 14 straight sessions, its longest winning streak over large caps since May 1996.

Translation: this isn’t a one-day fluke. It’s starting to look like a real sentiment shift, with money spilling out of the mega-cap comfort blankets and into the messier corners of the market.

So… why now? And, more importantly, can it last?

Why Investors Are Rotating Into Small Caps

1) The “cheaper menu” trade 💸

Small caps may look pricey on a headline price-to-earnings (P/E) mulitple, but that number gets skewed because a big chunk of the index is barely profitable.

From a more useful forward-looking view, small caps are trading around an 18x forward P/E vs. ~24x for the S&P 500. That amounts to a nearly 25% discount.

In a market that’s spent two years paying any price for AI winners, “on sale” starts to look attractive.

2) The economy narrative is broadening 🧩

Small caps live and die with the real economy, and Wall Street’s 2026 outlook has gotten noticeably sunnier.

Goldman’s Matthew Kaplan summed up the bullish setup as faster-than-consensus growth, cooler-than-consensus inflation, and continued Fed easing. He also noted that small caps tend to “outperform during cyclical rallies.”

Investors are basically saying: “If we’re seeing a broad-based expansion, why are we only buying seven stocks?”

3) Rate cuts are rocket fuel (for the right companies) ✂️

Small caps are much more rate-sensitive than large caps because they carry way more floating-rate debt.

Estimates vary, but roughly 45% of small-cap debt is floating-rate, vs. 9% for large caps. That means easing cycles matter more.

Markets are now pricing in two cuts for 2026, on top of the three already delivered in 2025. That’s real relief for interest expense — and lower interest costs flow straight to earnings, the single biggest driver of stock prices.

4) Policy tailwinds are sneaking into the story 🏛️

Investors also see a growing list of fiscal tailwinds for domestic businesses, especially smaller companies that reinvest profits at home.

A few big ones:

Section 179 super-expensing: Immediate write-offs for most small-business capital expenditures

Permanent pass-through deduction: Higher after-tax income for domestic operators

Full U.S. R&D expensing: Faster tax relief for innovation-heavy small caps

That matters because the Russell 2000 is far more U.S.-centric than the S&P 500, with 90% of revenue generated domestically (vs. 60-65% for large caps).

When the U.S. economy is the headline, small caps are the purest “America trade.”

Can The Run Continue?

There’s some historical evidence this streak could have legs.

Since 1979, the Russell 2000 has beaten the S&P 500 by more than 5% in January on five occasions. Four out of five times, small caps finished the year on top.

The Takeaway

To be clear, this looks like a rotation, not a revolution.

If you’re considering diversifying here, small caps don’t need to take over the whole portfolio to matter.

They’re only about 5% of the total U.S. equity market, so even a modest overweight doesn’t move a ton of capital. Think 6-10%, not an all-in bet. That extra few points still has to come from somewhere, but it’s a toe dip, not a cannonball.

One caveat: quality matters more here. Roughly 40% of the Russell 2000 is unprofitable. That’s not a dealbreaker, but it does mean stock-picking—or using higher-quality benchmarks—matters a lot more than it does in the S&P 500.

If there’s one thing to watch next, it’s guidance.

If small-cap earnings start backing up the optimism (with forecasts calling for faster growth than large caps), this rotation could keep running. If not, investors will sprint right back to the mega-cap safety raft.

MARKET MOOD

A Good Quarter Can’t Save Bad Guidance 🧾

Winners

Intel ($INTC) – Market Cap: $259.1B (5-day move: +11.5%)

Intel ripped higher ahead of earnings on AI buzz and optimism around its foundry business (i.e., making chips for other companies). That momentum quickly faded in yesterday’s after-the-close report. The quarter itself wasn’t ugly — revenue even topped estimates. Still, weak Q1 guidance reset expectations, triggering a sharp selloff that erased the whole week’s rally.

CRSPR Therapeutics ($CRSP) – Market Cap: $5.8B (5-day move: +6.9%)

Gene editing is finally turning into revenue. CRISPR jumped after CASGEVY topped $100M in 2025 sales, patient starts nearly tripled, and the company entered 2026 with $2B in cash. Add promising early data in cardiovascular gene editing, and optimism is creeping back in.

Losers

Abbott ($ABT) – Market Cap: $189.0B (5-day move: -13.1%)

Abbott suffered its worst one-day drop since 2002 after missing revenue estimates and issuing soft 2026 guidance. Nutrition sales fell 9% despite promotions, COVID testing continues to fade, and China remains a “challenging market.” When staples stumble, investors don’t wait around for the recovery.

GE Aerospace ($GE) – Market Cap: $312.8B (5-day move: -7.5%)

GE delivered a textbook “beat and raise” earnings report, then got sold off anyway. The issue? Growth is slowing. After a monster 2025, 2026 guidance points to mid-teens growth versus last year’s 24%. With the stock up ~50% in a year, expectations simply got ahead of this one.

Netflix ($NFLX) – Market Cap: $354.0B (5-day move: -5.7%)

Netflix beat earnings, but investors weren’t buying the sequel. Weak Q1 guidance, higher content spending, paused buybacks, and a pricey $72B chase for Warner Bros. Discovery spooked the market. Growth looks slower, costs look higher, and the stock is now 38% off its all-time highs.

OUR PARTNER: WISPR FLOW

Snippets that scale your voice

Save and insert standard intros, calendar links, and bios by voice so recurring emails and updates take seconds. Wispr Flow keeps your tone and speeds execution. Try Wispr Flow for founders.

FAST FACTS

Bullion, Berkshire, And Betting Markets 🎰

🥇 Four ways to buy gold: From miners and ETFs to physical bullion, this guide breaks down the pros, cons, and tradeoffs of owning gold. [Read]

🧀 Berkshire eyes the exit: Berkshire hinted it may sell part or all of its 28% stake in Kraft Heinz. Shares are now down 70% since the 2015 merger. [Read]

🎰 Sportsbooks feel the heat: DraftKings and Flutter slid after online betting revenue fell ~40% during NFL Wild Card weekend, while prediction markets saw record trading volumes. [Read]

🧊 Greenland deal framework emerges: Trump claims the U.S. reached a NATO-backed framework involving military bases and mineral rights in Greenland, including limited U.S. sovereignty over strategic zones. [Read]

🚗 Tesla gets cheaper insurance: Tesla shares rose after Lemonade offered a 50% insurance discount when Full Self-Driving is engaged, reinforcing the idea that autonomous driving could sharply reduce accident risk. [Read]

🤖 Elon vs. Sam heads to trial: Elon’s $134B lawsuit against Sam Altman is headed to a jury, with internal documents and OpenAI’s future hanging in the balance. [Read]

💵 Free money alert: Wells Fargo extended its $400 checking bonus through February, offering the payout after $3,000 in direct deposits within 90 days. [Read]

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

MENTIONS: $INTC ( ▼ 1.09% ) $CRSP ( ▲ 0.97% ) $ABT ( ▲ 2.75% ) $GE ( ▼ 1.23% ) $NFLX ( ▼ 3.37% )

Reply