- The Money Maniac

- Posts

- 💰 5 Fact Friday: Is $140K Enough?

💰 5 Fact Friday: Is $140K Enough?

A controversial article on X sparked chaos by suggesting $140K is the new baseline for getting by. Here’s what the author got right... and why it struck such a nerve.

Good morning, Maniacs!

I hope you had an amazing Thanksgiving and are already dominating your Black Friday wishlist. We’ll keep things quick today so you can get back to hunting deals.

If you’re heading to the airport this weekend, brace yourself. With nearly 82 million Americans traveling, Sunday is on track to break the TSA’s all-time record. Consider this your reminder to overpack snacks.

Now to the good stuff.

Google’s sprint toward a $4T valuation is turning heads, insider buying is ramping up during the tech pullback, and the IRS dropped a few new rules you might actually like. Plus, my take on the contentious article arguing why $140K doesn’t stretch like it used to.

Let’s dive in! 👇

OUR PARTNER: AMASS

Join Derek Jeter and Adam Levine

They’re both investors in AMASS Brands Group. You can join them and get up to 23% bonus stock. But only if you invest by Thursday, Dec. 4.

Why invest? They’re growing fast. Their brands cover everything from organic wine to protein seltzers. So with consumers seeking healthier options in the $900B beverage market, it’s no surprise AMASS has made over $80M to date, including 1,000% year-over-year growth.

They have even more ambitious plans for the future too. They’ve reserved the Nasdaq ticker $AMSS, enlisted a major investment bank to fuel their growth, and plan to 3X their retail footprint by 2028.

But your chance to amplify your investment with bonus stock ends soon. Become an AMASS Brands Group shareholder and secure your bonus stock by Dec. 4.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

STOCKS

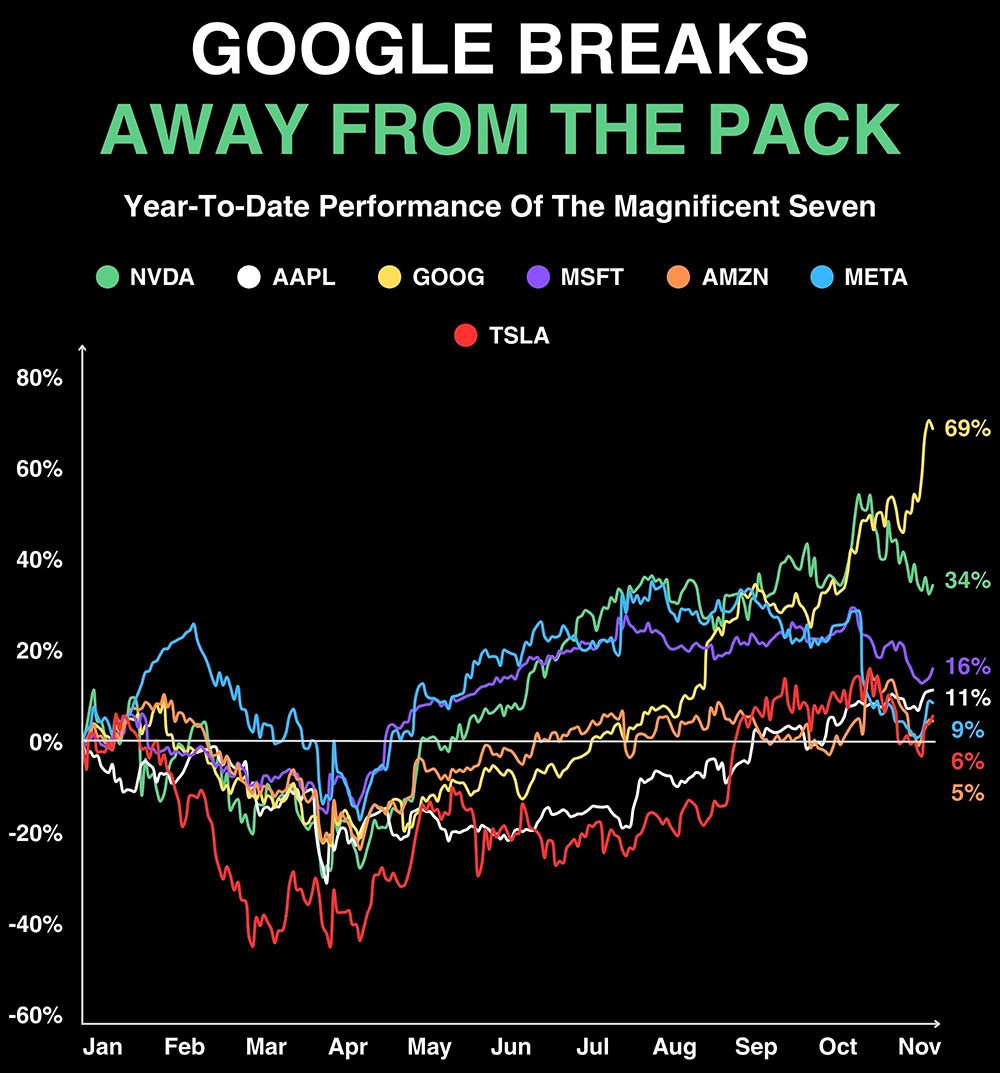

1. Google’s $500B AI Bump 🚀

One year ago, Google looked like the kid who forgot his science project. ChatGPT was stealing the spotlight, blue links felt outdated, and analysts wondered whether Google Search had finally met its match.

Then 2025 happened.

From “Washed” To “World-Class”

As Gemini 2, Nano Banana, and Gemini 2.5 racked up more than 600 million monthly users, Google quietly rebuilt its momentum.

Then, Gemini 3 made Google impossible to ignore, soaring to the top of multiple AI leaderboards and flipping the narrative in its favor.

The big twist? Gemini 3 wasn’t trained on Nvidia’s gold-standard GPUs… but Google’s own TPUs.

That matters because:

TPUs are specialized for matrix operations (i.e., AI math)

TPUs can be up to 4× more cost-efficient than GPUs

And they give Google more control over its tech stack

Suddenly, TPUs look viable. Viable enough that Meta is in talks to use them. And the market noticed.

Since Gemini 3 dropped last week, Google has added nearly half a trillion in market cap, driven by excitement over its AI lead and potential chip revenue.

Of course, investors are now mulling over what this might mean for Nvidia — still the largest public company in the world. Especially as the company offered a big-brother-style reassurance that it’s “delighted” for Google.

One Giant Question Remains

Even with top-tier AI, Google still faces the core dilemma:

Search is cheap to run and wildly lucrative. Chat is expensive to run and barely monetized.

Sure, Google is firing on all cylinders, but the entire AI industry (OpenAI included) is burning cash to support chat-based products that haven’t proven profitable.

Can Google find a way to reinvent Search without torching the business that funds everything from Waymo to DeepMind? Time will tell.

The long-term winner in AI won’t just build the best model — it’ll be the first to make the economics work. And that race is very much still on.

PERSONAL FINANCE

2. Why Earning $140K Feels Like Treading Water 👀

An article by Michael Green went mega-viral on X this week by asking a simple question: Why does the middle class feel like they can barely stay afloat?

Green went all the way back to the 1960s, when the federal poverty line was first created, and looked at how our economy has changed since then.

The Cost to Participate

When the poverty line was established decades ago, the math assumed a very different world:

Food was 33% of a family’s spending

One income could buy a home

Childcare basically didn’t exist

Healthcare cost ~$10/month

College was a summer-job problem, not a generational curse

Fast-forward to today, and the script has flipped. Food is now a tiny slice of the budget, while the other expenses have exploded:

Childcare: Up from free to 5-figures

Housing: The most unaffordable it’s ever been, relative to income

Healthcare and school: Essentially second and third rent payments

Technology: WiFi and smartphones can hardly be called discretionary

Put all that together, and Green estimated that a modern family of four needs an annual income of $140K just to get by.

Unsurprisingly, that number sparked chaos on X. Debates broke out about individual line items, amortization, and regional cost-of-living differences.

Although I agree the headline number is inflated and likely skewed by the Northeast, getting hung up on that misses the broader point:

The price of admission to the modern economy is much higher than it used to be. Middle-class families now juggle costs that have skyrocketed and “essentials” that didn’t even exist decades ago.

The Valley Of Death

The second big idea is what I’ll call effective taxation.

It’s the idea that “taxation” goes far beyond the progressive tax brackets we all know. As families earn more, parts of the social safety net fall away, and those disappearing benefits act like an additional layer of tax.

For instance, as a family’s income climbs from $40K to $140K:

They lose Medicaid

They lose childcare subsidies

They lose food support

They gain higher taxes

In other words, every extra dollar earned gets swallowed by higher costs or lost benefits. Lifestyle barely improves. In extreme cases, it even declines.

This helps explain the frustration so many middle-class families feel. They’re working harder, earning more… yet not actually moving forward.

Why Did This Strike A Nerve?

The truth is, a lot of people don’t feel like they’re doing fine, no matter what the official numbers say.

Keeping up with the Joneses is one thing, but this piece tried to map out a realistic middle-class baseline — something between true poverty and a luxury lifestyle. By laying out the actual cost of getting by and the “effective taxation” that hits families as they earn more, it showed why so many people feel squeezed even with solid incomes.

It’s an explanation, and maybe the explanation, for the financial anxiety running through the American middle class.

OUR PARTNER: MASTERWORKS

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

FAST FACTS

3. Tax Breaks, Tech Shifts, And TSA Upgrades 📲

🏋️ More muscle, younger brain? A study of 1,100 adults found that higher muscle mass and lower visceral fat are linked to slower brain aging, highlighting another limitation of BMI metrics. [Read]

📉 Insiders buy the dip: Corporate executives bought shares in their own companies at the fastest pace since May, signaling long-term confidence despite the market’s recent AI pullback. [Read]

💊 Eli Lilly joins the $1T club: Soaring demand for Mounjaro and Zepbound pushed Lilly past a $1 trillion valuation, making it the first healthcare firm to reach the milestone. [Read]

🛡️ Defense stocks slip on peace talk buzz: Trump hinted at progress in Russia-Ukraine discussions, sending European defense stocks down up to 4% and U.S. contractors slightly lower. [Read]

💼 Amazon’s biggest layoffs hit engineers: Nearly 40% of the company’s 4,700 recent job cuts were engineering roles, with gaming, advertising, and AI search teams taking hits. [Read]

💵 IRS rolls out tipping + overtime rules: The IRS issued early guidance on Trump’s new temporary deductions for tipped income and overtime pay, outlining who qualifies and how the breaks work. [Read]

📲 Apple launches Digital ID: Apple Wallet can now store U.S. passport details for TSA use at 250+ airports, though it won’t replace a physical passport or work for international travel. [Read]

TAX

4. 2026 IRA Limits Are Here 💸

Good news, retirement savers! The IRS just bumped up how much you can stash away in your IRA and Roth IRA in 2026.

Here’s your quick breakdown:

Contribution Limits: 2025 vs. 2026

IRA & Roth IRA (Under 50):

2025: $7,000

2026: $7,500

IRA & Roth IRA (Age 50+):

2025: $8,000

2026: $8,600

Traditional IRA Deduction Limits

Traditional IRA deductions depend on:

Whether you’re covered by a workplace retirement plan, and

Your MAGI (Modified Adjusted Gross Income).

(MAGI is similar to AGI, but adds back certain adjustments like student loan interest, foreign earned income, and foreign housing deductions. For many filers, MAGI and AGI are the same.)

If you are covered by a workplace retirement plan:

2025:

Single: Full deduction < $79,000; partial up to $89,000; none > $89,000

Married filing jointly: Full < $126,000; partial up to $146,000; none > $146,000

2026:

Single: Full deduction < $81,000; partial up to $91,000; none > $91,000

Married filing jointly: Full < $129,000; partial up to $149,000; none > $149,000

If you are not covered by a workplace retirement plan:

You generally get full deductions unless you’re married filing jointly and your spouse is covered. In that case, your deduction phases out:

2025: $236,000 → $246,000

2026: $242,000 → $252,000

Roth IRA Income Limits

Roth IRA eligibility depends solely on your MAGI.

2025

Single: Full contribution < $150,000; partial up to $165,000; none > $165,000

Married filing jointly: Full < $236,000; partial up to $246,000; none > $246,000

2026:

Single: Full < $153,000; partial up to $168,000; none > $168,000

Married filing jointly: Full < $242,000; partial up to $252,000; none > $252,000

One More Tip For The Road

If your income is too high for a Roth, nondeductible IRA contributions can still be useful. Plus, there’s always the backdoor Roth route. We’ll break that down in next week’s edition.

TRIVIA

5. What Percent Of Cards Are Seriously Delinquent? 💳

Americans are still swiping… but they’re also slipping.

With credit card interest rates holding firmly above 20% and household budgets stretched thin, more borrowers are falling behind on their bills. In fact, serious delinquencies (90+ days late) just hit their highest level since 2011.

What percentage of U.S. credit card accounts are more than 90 days delinquent?

Take your guess:

0.8%

5.0%

9.4%

12.4%

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

Reply