- The Money Maniac

- Posts

- 💰 5 Fact Friday: Elon’s $8.5 Trillion Challenge

💰 5 Fact Friday: Elon’s $8.5 Trillion Challenge

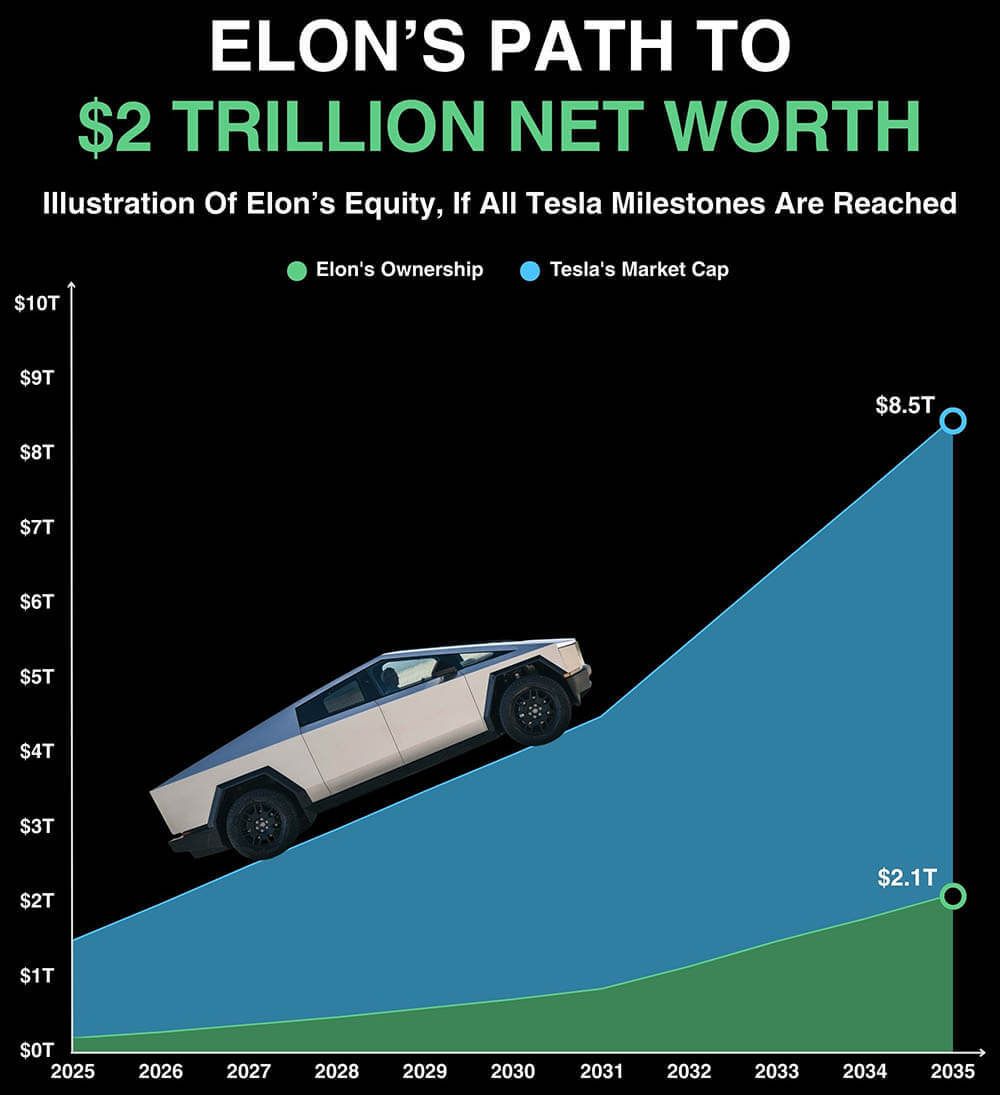

Elon Musk just got the green light for a pay package worth $1 trillion. To earn it, he’ll need to grow Tesla to $8.5 trillion. That’s more than Apple and Microsoft combined.

Good morning, Maniacs!

Markets pulled back slightly this week amid growing chatter of an AI bubble. The issue? Earnings remain strong, demand is still growing, and hyperscaler spending plans look full throttle through 2026. Unless the data turns, the bulls are still in control.

Of course, Michael Burry sees it differently. The Big Short legend is once again shorting the boom, betting big against Nvidia and Palantir.

Meanwhile, Elon Musk just got the green light for a pay package worth $1 trillion.

To earn it, he’ll need to grow Tesla to $8.5 trillion. That’s more than Apple and Microsoft combined. Ambitious? Yes. Impossible? Maybe. But if there’s one person I’d rather not bet against, it’s the guy catching rockets and beaming wifi down from space.

In other news, the government shutdown just rolled into day 38.

Thousands of flights may be canceled today due to staffing shortages. Plus, the Trump administration could lose its tariff case in the Supreme Court. However, they did book a win in the GLP-1 price wars. Weight loss drugs will now cost just $50 for Medicare recipients, and $150 to $350 for everyone else.

Let’s dive in! 👇

OUR PARTNER: ATTIO

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

MARKETS

1. The Big Short Ignites AI Panic 📉

It’s been a choppy week for tech as the AI panic made a comeback. All three major indices fell between 1.4% and 2.8%, Bitcoin slipped below $100K, and even gold lost its shine, dipping back under $4K.

What spooked investors? A trio of headlines:

1) Michael Burry Is Bearish

Played by Christian Bale in The Big Short, Michael Burry is famous for predicting the 2008 housing crash. Now he’s back, with massive bets against Nvidia and Palantir, and a warning on X: “sometimes the only winning move is not to play.”

Palantir’s outspoken CEO didn’t take that kindly, calling Burry “bats*** crazy.”

2) Sam Altman Is Defensive

The OpenAI CEO raised eyebrows after snapping at podcast host Brad Gerstner, who asked how the company plans to fund its trillion-dollar ambitions. Instead of outlining OpenAI’s growth plan, Altman fired back that Gerstner could “sell [his] shares.” Not exactly the calming reassurance investors were hoping for.

3) Bankers Are… Sane?

At a recent conference, Goldman Sachs’ David Solomon said a 10-20% drawdown over the next 1-2 years is likely. Morgan Stanley’s Ted Pick agreed, saying a 10-15% correction would be healthy.

In other words, stocks don’t go up in a straight line. Given that the average intra-year drawdown is 14%, these aren’t exactly doomsday predictions — just a reality check.

Beneath the headlines, the data tells a calmer story:

Earnings are up 10.5% in Q3, the best showing in four years.

Hyperscalers like Amazon, Google, Meta, and Microsoft are still investing aggressively in AI.

Yes, the S&P 500 is fully valued.

With a forward P/E of 22.9, it’s 15% above the 5-year average and 23% above the 10-year average. But companies are growing margins and profits faster than normal, while investing in future productivity.

So here’s the real divide:

AI bears think it’s a house of cards.

AI bulls think it’s the next transformative technology.

So far, earnings back the bulls. But as always, the future has the final say.

Do you think the AI rally still has room to run? |

DEAL CORNER

2. Wall Street’s Deal Sheet Of The Week 📰

🤖 Tesla OKs Musk’s $1T Pay: Shareholders approved Elon Musk’s wild $1 trillion pay plan. But, he only gets the full bag if Tesla hits an $8.5T valuation and launches robotaxis, full self-driving, and 20M vehicles. [Read]

🚕 Waymo Expands to More Cities: Alphabet’s Waymo is rolling out robotaxis in San Diego, Las Vegas, and Detroit—snow, tourists, and all. A London launch is coming in 2026. [Read]

💰 Amazon’s $38B OpenAI Boost: Amazon signed a 7-year, $38B deal to host OpenAI’s workloads on AWS. The deal includes access to Nvidia chips and could add 20% to AWS’s backlog. [Read]

🧠 Apple to Pay Google $1B for AI: Apple will reportedly pay Google $1 billion annually to power Siri with Google’s massive 1.2 trillion-parameter AI model. [Read]

💊 Novo and Pfizer Battle for Metsera: Novo offered up to $10B for weight-loss biotech Metsera, outbidding Pfizer’s $8.1B. Pfizer responded with lawsuits to keep its deal alive. [Read]

🧻 Kimberly-Clark’s $48B Mega-Merger: The Kleenex maker is buying Kenvue (Tylenol, Listerine) for $48B. Investors love the brands, pushing Kenvue up 12%, but hate the price, sending Kimberly-Clark down 15%. [Read]

🏦 UBS Eyes U.S. Relocation: UBS applied for a U.S. national bank charter, fueling speculation it could move its headquarters from Switzerland to the States. [Read]

🍕 Papa John’s Deal Falls Apart: Apollo dropped its $64/share bid to take Papa John’s private. The pizza stock plunged 21% ahead of earnings. [Read]

OUR PARTNER: ATTIO

Powered by the next-generation CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

ECONOMY

3. Tariffs Get Their Day In Court 🏛️

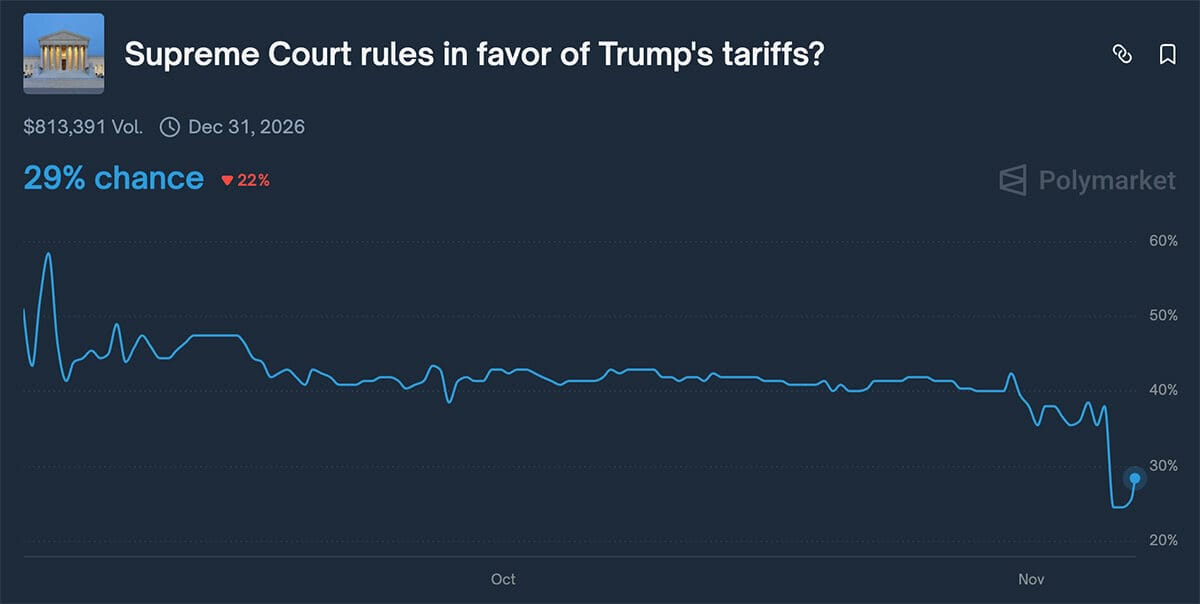

President Trump’s tariff battle is now unfolding before the Supreme Court.

At the center is the International Emergency Economic Powers Act (IEEPA) — the tool Trump used to impose global “reciprocal tariffs” as well as additional “fentanyl tariffs” on Canada, Mexico, and China.

Critics call it executive overreach, arguing that only Congress can levy taxes and duties. Even Chief Justice Roberts raised eyebrows, invoking the “major questions” doctrine to question whether the president should have that kind of unchecked power.

Prediction markets aren’t feeling optimistic for the White House. After oral arguments on Wednesday, the odds of the government winning dropped from 38% to 29%.

If the Court strikes down the tariffs, the average U.S. tariff rate could fall from roughly 17% to 9%, according to economists.

Here’s what that might mean:

Winners: Import-heavy companies (think Walmart, Target, automakers) get cheaper goods, lifting margins.

Losers: U.S. manufacturers protected by tariffs face cheaper foreign competition.

Consumers: Could finally catch a break. Goldman Sachs estimates households currently pay 55% of all tariff costs.

The bigger picture:

The U.S. is on pace to collect $400 billion in tariffs per year, roughly 8% of total federal revenue.

Despite that, Washington is still running a $1.8 trillion deficit and carrying a $38 trillion national debt.

The Court’s decision is expected by mid-2026, though markets are already pricing in a rollback. Stocks rallied on Wednesday on hopes for “freer” trade, with small caps, retail, and automakers leading the charge.

Still, don’t expect tariffs to disappear overnight.

Treasury Secretary Scott Bessent hinted that if the ruling goes against them, there is a “Plan B.” The administration will rebuild tariffs using other legal authorities, such as Section 232 or Section 301.

Bottom line: If tariffs fall, markets might party at first… but the hangover of policy whiplash could last well into 2026. And in markets, uncertainty is the ultimate buzzkill — bad for investment, bad for growth, and bad for stocks.

STOCKS

4. Corporate Scorecards Are In 🔥

🏨 Airbnb: Travel demand is holding steady. Revenue rose 10% to $4.1 billion, and the company delivered another profitable quarter with over $1.3 billion in net income. Holiday guidance looks solid too, sending shares up 5% in after-hours trading.

💾 AMD: The chipmaker beat on both earnings and revenue, driven by a 22% jump in data center sales and record PC chip performance. With guidance also coming in above Wall Street estimates, AMD is showing it’s still a serious player in the AI hardware race.

🍔 McDonald’s: Profit missed slightly, but sales held up. Global same-store sales rose 3.6%, with U.S. growth at 2.4%, helped by value deals and bigger order sizes. Management called it proof that even in a tough consumer environment, the golden arches can still deliver.

💉 Novo Nordisk: Earnings came in line, but the drugmaker trimmed its growth forecast (again) amid stiff competition and pricing pressure in the weight-loss market. Shares fell 5% and are down 45% this year as rival Eli Lilly takes the lead in the booming GLP-1 drug race.

🧠 Palantir: The data analytics firm crushed expectations with revenue up 63% and U.S. commercial sales more than doubling year-over-year. The company raised its full-year forecast as demand surges for its new AI-powered software platform. Despite the strong quarter, shares fell 8%.

📶 Qualcomm: The chipmaker beat on earnings and revenue as it pushes beyond smartphones into AI, PCs, and VR. But with Apple phasing out its modem chips and Nvidia still dominating AI, Qualcomm has ground to make up.

📈 Robinhood: Revenue doubled to $1.5 billion, and profit more than tripled to $556 million. Trading activity, however, fell short of expectations. Executives highlighted strong momentum in new business lines like prediction markets and crypto exchange Bitstamp.

🛍️ Shopify: Revenue and online sales volume came in strong, but profits were flat. The company’s growth strategy is clearly working as operating income jumped 53%, but ongoing investments dragged on the bottom line.

🚗 Uber: Reported a huge profit, though mostly thanks to a one-time $4.9 billion tax benefit. The real story? Bookings and trips both grew over 20% from last year, and Q4 guidance was upbeat. Demand remains strong, as the platform grew to 189 million monthly active users.

TRIVIA

5. How Old Is The Typical First-Time Homebuyer? 🏠

In 1985, the typical American bought their first home at 29.

Forty years later, sky-high prices, steeper down payments, and a wave of all-cash buyers have pushed homeownership further out of reach.

How old is the median first-time homebuyer in 2025?

Take your guess:

🟢 30 years old

🔵 35 years old

🟡 40 years old

🔴 45 years old

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

Reply