- The Money Maniac

- Posts

- 💰 Big Tech Report Cards Are In

💰 Big Tech Report Cards Are In

Four earnings reports, two grades each, and one contrarian "A"

Good morning, Maniacs!

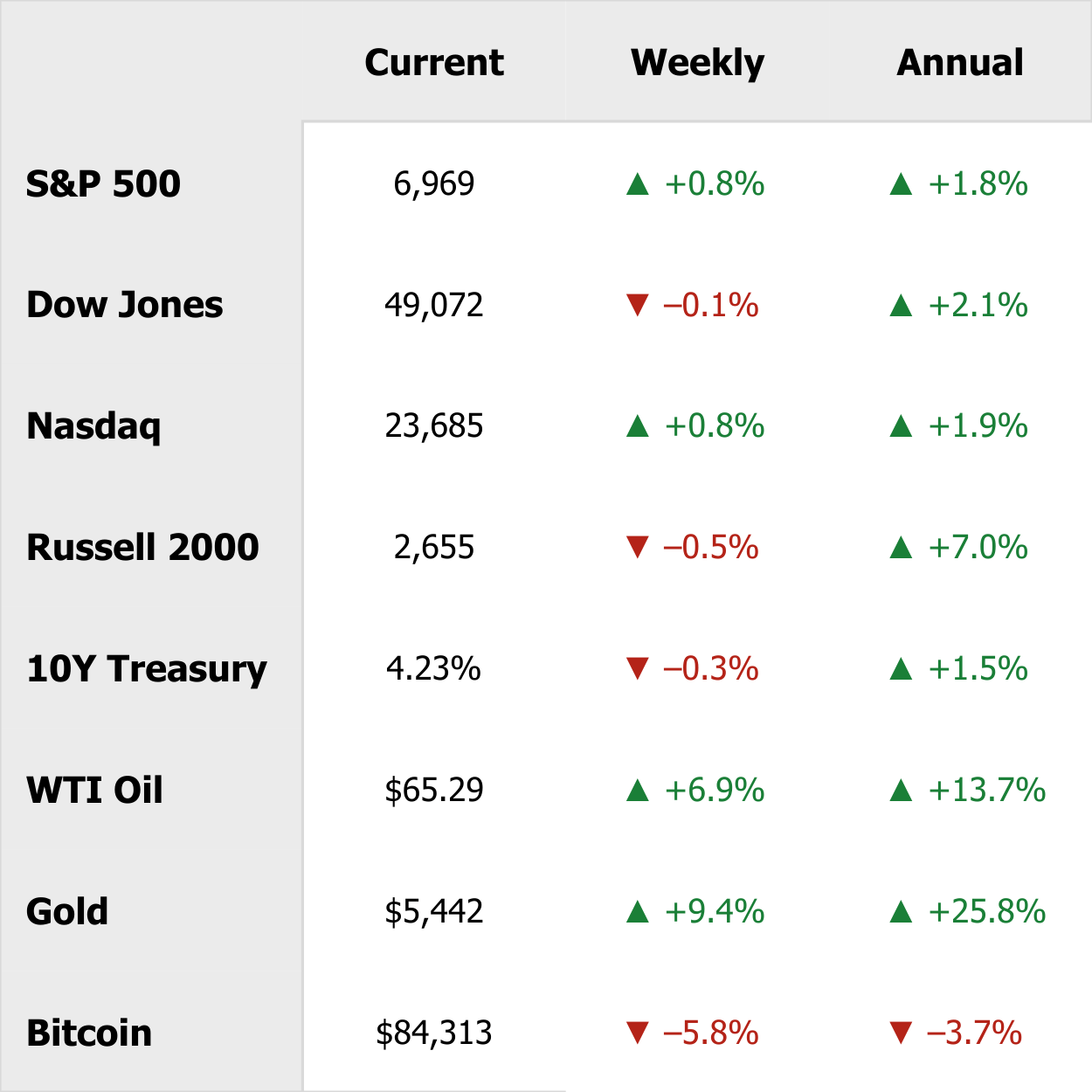

Is the vibecession back?

Consumer confidence just slid to 84.5, its lowest reading in nearly a decade, as Washington noise, inflation anxiety, and labor-market jitters creep back into the conversation.

And yet… the hard data refuses to roll over. GDP trackers are pointing north of 5%, jobless claims remain calm, and inflation is cooling, slowly but steadily.

Even markets seem torn.

The Fed hit pause after three straight cuts, the dollar has quietly weakened, and gold keeps sprinting higher (sigh). Meanwhile, the TikTok deal is officially in the books. Shoutout to the 75% of you who called it, including Andrew Maynard, Nichole Bryant, and Lorenzo Mosig.

Today, we’re breaking down how big tech earnings fared, why Medicare insurers got crushed, and where you can still earn a pension in 2026.

Let’s dive in! 👇

OUR PARTNER: WISPR FLOW

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

THE MAIN EVENT

Big Tech Report Cards Are In 📝

Four of the seven largest companies on the planet just reported earnings, and together, they gave us a pretty clean read on where we are in the massive AI spending cycle.

Spoiler: the money spigot is still wide open, but Wall Street is getting pickier about how that money gets spent.

Here’s the Big Tech report card, with two grades for each company:

How the market reacted

How this quarter actually looked under the hood.

(Note: my grades and takes are for informational purposes only and do not constitute investment advice.)

🚗 Tesla ($TSLA)

Hard Numbers: $24.9B revenue. $0.8B net profit, down 61% year-over-year. Vehicle deliveries fell about 15%. Energy profits helped offset automotive weakness. Tesla plans to retire Model S and X production.

Market Grade: C (5-day move: -7.3%)

My Grade: B-

Tesla posted its first-ever annual revenue decline, and investors were quick to punish the stock. But this quarter wasn’t really about cars.

What mattered more:

Robotaxi pilots are already running in Austin and the Bay Area, with six more cities planned this year.

Musk says Tesla could cover 25-50% of the U.S. population with robotaxis by year-end.

Humanoid Optimus robots remain on track for production later this year.

Tesla is investing $2B into xAI, tying its future tightly to autonomy and AI.

Honestly, a B-minus may be generous. You have to look past the ugly car sales and bet on the regulatory tailwind instead. A lighter regulatory environment could accelerate FSD and robotaxis in ways that weren’t realistic just a few years ago.

Of course, regulatory relief won’t solve engineering problems. But it’s hard to count out Elon Musk. He’s notorious for missed timelines — yet he has a habit of getting there eventually.

🍎 Apple ($AAPL)

Hard Numbers: $143.8B revenue vs $138.4B expected, an all-time record. $42.1B profit, up 16%. iPhone revenue surged 23% to $85.3B. Services revenue grew 14%. Active devices surpassed 2.5B globally.

Market Grade: A (5-day move: +4.0%)

My Grade: A-

Apple smashed the quarter because consumers finally upgraded their phones. Sales were strong across every geographic region, including China, where Apple had struggled recently.

That said, this feels more like a capitulation cycle than an upgrade cycle. People bought the iPhone 17 because their old phones were dying, not necessarily because the new features were revolutionary.

More concerning, Apple and Siri still lack a native AI engine. By outsourcing the brain to Google/Gemini instead of building its own, Apple is saving on capex today, but passing the intellectual leverage to a competitor. This could turn them into a premium hardware shell for other people’s AI.

🌐 Meta ($META)

Hard Numbers: $59.9B revenue, up 24% year-over-year. $22.8B net income with a 38% net margin. Q1 revenue guidance above $53.5B. 2026 capex guided to $115B to $135B, nearly double last year’s $72B.

Market Grade: A+ (5-day move: +14.0%)

My Grade: A-

Meta remains the ad-tech king, and this quarter delivered exactly what investors wanted to see.

AI is no longer a science project. It is actively improving ad targeting, boosting engagement, and pushing ad prices higher. That combination powered strong earnings and optimistic guidance.

In other words, Meta is proving that AI can drive cash flow today, not just promise breakthroughs tomorrow. That’s why the stock ripped higher.

The real risk lies in the scale of the bet. Zuckerberg is essentially betting the entire company's cash flow on Llama (the AI model) and Agents.

That wager could miss, much like the VR push that eventually turned Facebook into Meta. Or it could be directionally right, but still disappoint if AI agents don’t monetize nearly as well as the old scrolling newsfeed.

Either way, the size of the spend matters. This capex build-out is so large that even modest underperformance could become a long-term drag on Meta’s otherwise beautiful margins.

☁️ Microsoft ($MSFT)

Hard Numbers: $81.3B revenue vs $80.3B expected. $38.3B operating income, good for a 47% margin. Cloud revenue topped $50B for the first time. Quarterly capex hit $37.5B, up 66% year-over-year. Commercial remaining performance obligations climbed to $625B.

Market Grade: B- (5-day move: -3.9%)

My Grade: A

Despite beating revenue and profit expectations, Microsoft’s stock sold off hard, falling nearly 10% yesterday. The trigger was simple: Azure grew 39% instead of the 40% investors were hoping for, while capital spending kept climbing.

That reaction says more about expectations than fundamentals. A one-point slowdown in cloud growth is not a collapse.

The more legitimate concern is concentration risk. Roughly 45% of Microsoft’s backlog is tied to OpenAI, meaning any stumble in OpenAI’s ability to monetize at scale would make that backlog look less ironclad.

However, the company also rolled out its Maia 200 AI chip to reduce reliance on Nvidia, signed a $750M multi-year Azure deal with Perplexity, and crossed 15 million paid Copilot seats.

This is what makes Microsoft more than just an AI spender. It is a full-stack landlord.

That structure creates both a margin cushion and a built-in safety valve against overbuilding. With massive internal demand and a deep bench of external customers, Microsoft can shift seamlessly between using compute itself and selling it to others.

MARKET MOOD

A Tough Week To Be United ⚠️

Winners

Royal Caribbean ($RCL) – Market Cap: $94.4B (5-day move: +21.1%)

Royal Caribbean reminded investors that consumers are still spending, especially on vacations. Sales jumped 12% and profit soared 72% as onboard spending stayed strong. Management talked up such a hot 2026 outlook that even rivals Carnival and Viking caught a sympathy bump.

Southwest Airlines ($LUV) – Market Cap: $25.5B (5-day move: +14.3%)

Southwest finally leaned into change, and Wall Street is LUV-ing it. The airline beat earnings and unveiled a massive 2026 profit target, up more than 300% from 2025. Bag fees, seat assignments, and premium seating are doing the heavy lifting. Purists worry Southwest is starting to look like everyone else. Investors seem fine with that… for now.

Losers

United Rentals ($URI) – Market Cap: $50.6B (5-day move: -17.7%)

United Rentals delivered a triple miss: earnings, revenue, and guidance all came in below expectations. Yes, Q4 sales hit a record $4.2B, and yes, management announced a $5B buyback and a 10% dividend hike. But weak used-equipment sales and rising delivery costs stole the spotlight.

UnitedHealth ($UNH) – Market Cap: $264.8B (5-day move: -17.5%)

Nothing broke at UnitedHealth — Washington just moved the goalposts. The White House proposed near-flat Medicare rates for 2027: a 0.09% bump, or about $700M, compared to $30B in added payouts this year. That’s tough for insurers reliant on government money. UNH slid, and CVS and Humana followed. Rough for the sector, great for spending discipline.

OUR PARTNER: FISHER INVESTMENTS

Will Your Retirement Income Last?

A successful retirement can depend on having a clear plan. Fisher Investments’ The Definitive Guide to Retirement Income can help you calculate your future costs and structure your portfolio to meet your needs. Get the insights you need to help build a durable income strategy for the long term.

CHART OF THE WEEK

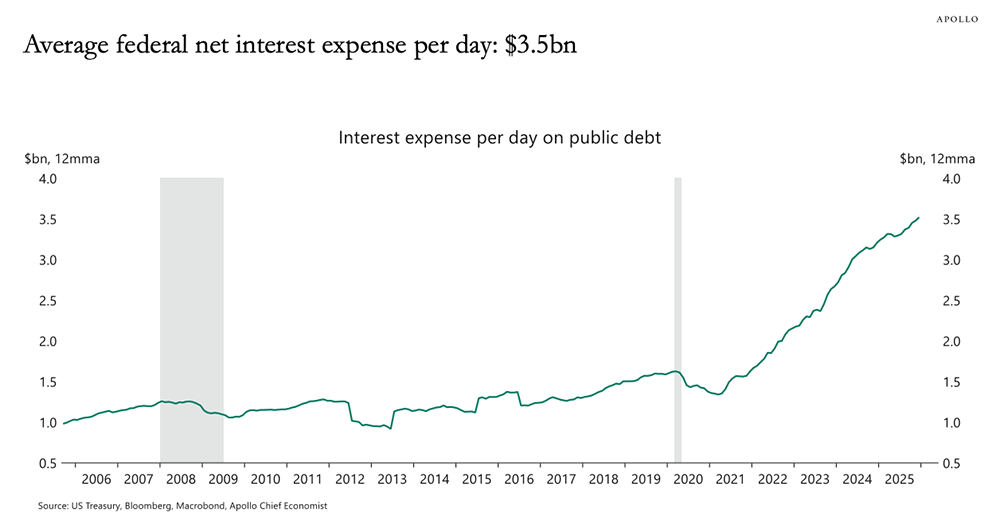

America’s Debt Is Compounding In Plain Sight 📈

In the time it takes you to read this email, the U.S. government will spend $10+ million paying interest on old bills.

That spending now tops the entire defense budget.

This is easy to wave off as tomorrow’s problem, but the math doesn’t wait. Policymakers move slowly, while interest compounds relentlessly. Each year of delay raises the cost — and guarantees that the eventual fix will be more painful.

FAST FACTS

The Hunt For Alpha Goes Global 🌍

🚀 10 growth stocks worth watching: Two AI giants top the list for 2026, but banks and a pharma heavyweight also sneak into the top tier. [Read]

🔄 A new source of “alpha”: Big money managers aren’t dumping U.S. stocks, but they’re rebalancing around the edges. [Read]

💼 How pros would invest $100K: Four advisors say the next big opportunity isn’t AI, tech, or even the U.S. Think defense, diversification, and a surprising overseas market making a comeback. [Read]

💵 Why the dollar is sliding: A weaker dollar isn’t market noise. It’s tied to a policy shift that favors domestic manufacturing and exports. [Read]

🏦 9 jobs still offering pensions: Lifetime income isn’t totally dead, but it’s increasingly limited to government workers, unions, and a few private-sector holdouts. [Read]

🏠 401(k)s aren’t piggy banks: Trump pushed back on using retirement funds for home down payments. Experts warn this short-term fix can quietly sabotage long-term wealth. [Watch]

🧾 New tax breaks are live: Tipped workers can deduct up to $25K, and overtime earners can deduct up to $12.5K. But the perks expire in 2028 and don’t eliminate payroll or state taxes. [Read]

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

MENTIONS: $LUV ( ▲ 0.02% ) $RCL ( ▲ 1.53% ) $UNH ( ▲ 0.02% ) $URI ( ▲ 2.26% ) $TSLA ( ▲ 0.03% ) $AAPL ( ▲ 1.54% ) $META ( ▲ 1.69% ) $MSFT ( ▼ 0.31% )

Reply