- The Money Maniac

- Posts

- 💰 Big Stick Economics Is Back

💰 Big Stick Economics Is Back

U.S. markets are grappling with the return of a very old playbook, the Monroe Doctrine. Except today’s version, the “Donroe Doctrine,” looks like less nation-building and more supply-chain building.

Good morning, Maniacs!

Geopolitics is back in the driver’s seat. Venezuelan oil is dominating headlines, Greenland reentered the chat, and we could even get a Supreme Court ruling on tariffs as early as today.

CES, tech’s biggest annual stage, wrapped up in Las Vegas, and markets once again hung on every word from Nvidia’s Jensen Huang.

But the baton quickly passed from Vegas to Washington.

Trump went carrot and stick with defense contractors, floating up to a 50% increase in defense spending while threatening to cap CEO pay for firms missing contract deadlines.

It all adds up to a market that feels anything but settled.

One last thing before we start: this is your LAST CHANCE to be part of the 2026 Crystal Ball Challenge. It takes just two minutes to lock in your predictions.

Now, let’s dive in. 👇

OUR PARTNER: GLADLY.AI

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

THE MAIN EVENT

Big Stick Economics Is Back On The Global Map 🗺️

Unless you’ve been living under a rock, you likely know that over the weekend, U.S. forces captured Venezuelan strongman Nicolás Maduro.

Now, I’ll leave the hot takes about whether this is “good” or “bad” to the professionals on X.

From an investor’s seat, the only thing that matters is what is happening, what might happen next, and how markets price those possibilities. After all, second- and third-order effects are where the real money is made.

What’s clear is that U.S. markets are grappling with the return of a very old playbook — the Monroe Doctrine. Except today’s version, the “Donroe Doctrine,” looks like less nation-building and more supply-chain building.

Venezuela and the Limits of “Proven” Oil

Maduro was an illegitimate leader, a brutal dictator, and a human rights violator whose policies triggered one of the largest migration crises in modern history.

He was also the primary roadblock to what are often described as the world’s largest “proven” oil reserves.

Venezuela claims roughly 300 billion barrels, about 17% of global reserves — a figure that comes with important caveats.

Much of that oil was reclassified under Hugo Chávez without major new discoveries. It’s extra-heavy crude: expensive to extract, difficult to refine, and requires blending or upgrading before it’s usable. This isn’t oil you turn on with a switch.

That helps explain the paradox:

Venezuela has mountains of oil

In the 1970s, it pumped 3.5 million barrels per day (bpd), more than 7% of global supply

Yet today, it produces just 1 million bpd, less than 1% of global supply

How Venezuela Broke Its Own Oil Industry

After seizing assets in the 2000s, including operations from Exxon Mobil (XOM), ConocoPhillips (COP), and others, the socialist regime stopped reinvesting.

Infrastructure aged

Foreign capital fled

Cash was siphoned into power preservation, not maintenance

The oil stayed underground while pipelines rusted above it. As a result, reviving production isn’t cheap or fast:

Estimates range from tens to hundreds of billions of dollars needed to materially increase output

The track record of nationalization raises long-term risk for any investor

That’s why, rather than slumping from an incoming supply glut, oil prices are actually up +1.9% this week.

Markets Pick Their Winners Carefully

Instead of oil itself, markets chased the picks-and-shovels businesses.

The energy equipment and services industry jumped immediately, with sharp 5-day moves in:

Schlumberger (SLB) +16%

Halliburton (HAL) +14%

Baker Hughes (BKR) +10%

Why? Because if Venezuela comes back online, these companies would be first in line to rebuild its oil industry.

Gulf Coast refiners sit in a sweet spot, too. Venezuelan crude is heavy and sulfur-rich, exactly the grade many U.S. refineries were built to process.

Over the past 5 days, refiners have posted outsized gains:

PBF Energy (PBF) +19%

Valero (VLO) +18%

Phillips 66 (PSX) +12%

Chevron (CVX) is also up 4%, as it’s the only U.S. major with active licenses and boots on the ground, giving it the clearest path to scale output.

Meanwhile, Venezuela’s own stock market exploded. The IBC index surged 75% in just two days, reflecting optimism that sanctions relief and foreign capital could finally return.

The Canada Problem

There’s another ripple investors shouldn’t miss: Canada.

Venezuelan crude competes directly with Canadian supply because both barrels target the same U.S. refiners.

If Venezuelan oil flows again, it likely comes at Canada’s expense, capping upside for producers like:

Canadian Natural Resources (CNQ) -7%

Cenovus (CVE) -3%

Imperial Oil (IMO) +3%

Suncor (SU) +3%

Canada currently exports ~3.5 million bpd to America. That privileged position has been a tailwind for years, and it’s also what’s most exposed to disruption.

Zooming Out: Greenland, Canals, and Cold-War Math

This stops being just an oil story when you zoom out.

The willingness to exert control over Venezuela has reignited talk of buying Greenland, owned by Denmark. The island is resource-rich, strategically located in the Arctic, and loaded with rare earths used in defense and manufacturing.

As soon as Trump mentioned Greenland again, markets reacted:

Critical Metals (CRML) surged 94%

Prediction-market odds around U.S. control of the Panama Canal ticked higher

While it’s hard to know what comes next, a clear pattern is emerging:

Oil. Minerals. Raw materials. Shipping lanes. Less dependence on China. More leverage over the inputs that drive inflation, growth, and national security.

This isn’t about ideology. It’s about who controls the pressure points of the global economy. Invest accordingly.

MARKET MOOD

Nvidia Giveth, Nvidia Taketh Away ⚡️

Winners

Sandisk ($SNDK) – Market Cap: $49.0B (5-day move: +40.9%)

AI isn’t just about GPUs anymore — it’s about where the data lives. SanDisk ripped higher after Nvidia’s Jensen Huang called storage a “completely unserved market” for AI. As bandwidth becomes the new bottleneck, investors are piling into memory names like SanDisk and Micron.

Joby Aviation ($JOBY) – Market Cap: $13.9B (5-day move: +15.5%)

Joby is shifting from cool tech demo to real manufacturing story. The autonomous helicopter company acquired a second Ohio production site and took delivery of FAA-grade flight simulators this week. Joby plans to double aircraft output by 2027 as it anticipates “significant future growth.”

Losers

Roblox ($RBLX) – Market Cap: $51.9B (5-day move: -8.8%)

Roblox warned that rising safety and infrastructure spending will weigh on profits, overshadowing strong bookings and a 70% year-over-year surge in daily users. Add an insider share sale to the mix, and suddenly investors were less excited about the metaverse party.

Johnson Controls ($JCI) – Market Cap: $72.8B (5-day move: -7.0%)

On Monday, Nvidia announced its next-gen Rubin chips. The new processors are faster, cheaper to run, and no longer require traditional water chillers. That last part rattled cooling-system makers like Johnson Controls, as a key revenue stream could come under pressure.

OUR PARTNER: GOOGLE ADSENSE

Easy setup, easy money

Your time is better spent creating content, not managing ad campaigns. Google AdSense's automatic ad placement and optimization handles the heavy lifting for you, ensuring the highest-paying, most relevant ads appear on your site.

CHART OF THE WEEK

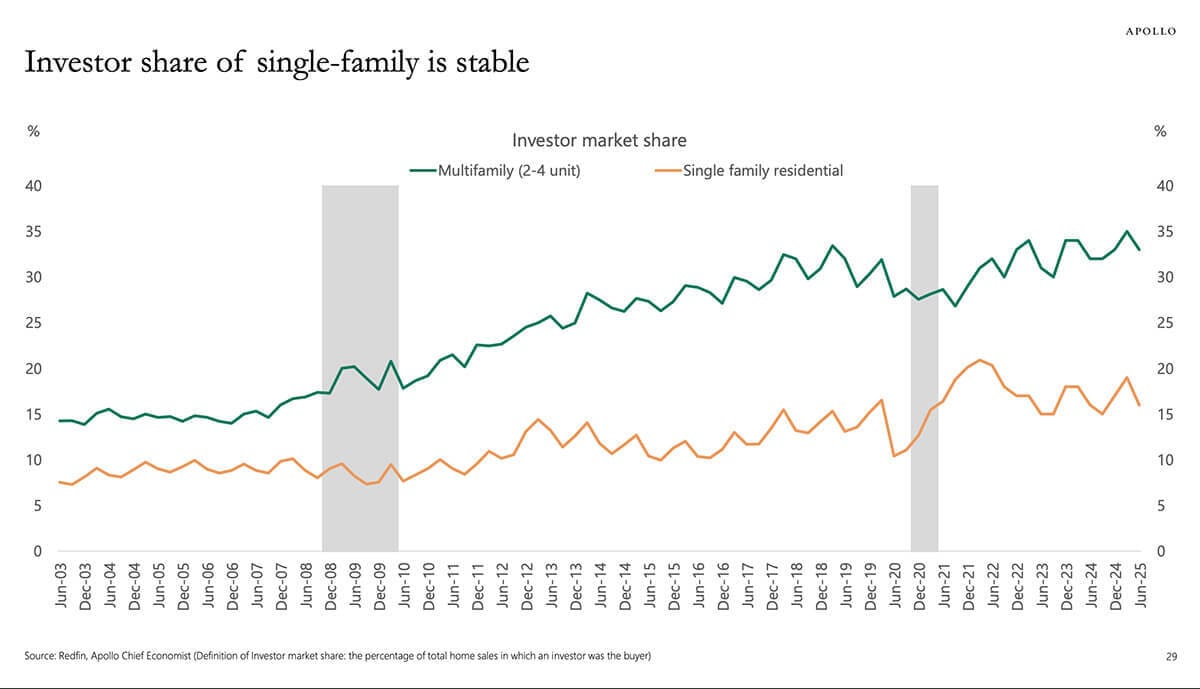

Who Really Owns America’s Homes 🏠

Investor ownership of single-family homes has stabilized in recent years, but it’s still about double where it was two decades ago.

This week, President Trump announced plans to ban institutional investors from buying single-family homes in an effort to ease pressure on first-time buyers. Blackstone (not to be confused with BlackRock) fell more than 5% on the news.

That said, outside a handful of markets like Atlanta and Charlotte, large investors generally aren’t dominating the housing stock. Institutions hold fewer than 1 million single-family homes nationwide.

By comparison, small “mom-and-pop” landlords (those owning 1-9 properties) control an estimated 11 million units.

At the risk of sounding like a broken record, this fix is basically a band-aid on a bullet hole. You don’t cure high prices by banning buyers — you cure them by adding supply.

FAST FACTS

Bonuses, Billionaires, and Bills Coming Due 📬

💳 Free $250 from Capital One: Capital One is offering a $250 checking bonus with no deposit required. Use the DEBIT250 code and make 20 debit purchases of $10+ within 75 days. [Read]

🏝️ Billionaires flee California taxes: Google co-founder Larry Page bought $173M worth of Miami real estate as California floats a one-time 5% wealth tax. Florida and Texas continue winning the billionaire migration. [Read]

🎓 Student loan collections restart: Fewer than 40% of borrowers are current on payments. After a five-year pause, wage garnishments are resuming, with 1,000 notices going out this week and more coming monthly. [Read]

🖊️ OpenAI’s first gadget may be a pen: A leak suggests OpenAI is working on a smart AI pen with always-on listening, voice notes, and ChatGPT assistance. [Read]

🤖 Humanoid robots hit factory floors: Hyundai plans to deploy Atlas robots from Boston Dynamics in factories starting in 2028, joining Amazon, Tesla, and BYD in automating physical labor with human-like machines. [Read]

🧊 Why Greenland suddenly matters: Melting Arctic ice is opening new trade routes and exposing rare minerals, putting Greenland at the center of U.S., China, and Russia’s growing security competition. [Read]

Thanks For Reading!

How was today's email? |

Spread The Wealth 💸

Like what you read? Do me a favor and don’t keep it a secret! Send this newsletter to a friend and help them level up their financial game—one fact at a time.

Click the button above -or- copy and paste this link: https://read.themoneymaniac.com/subscribe?ref=PLACEHOLDER

DISCLAIMER: The information provided in this newsletter is for informational purposes only and should not be construed as financial advice or a solicitation to buy or sell any assets. All opinions expressed are those of the author and are subject to change without notice. Please do your own research or consult with a licensed professional before making any investment decisions.

MENTIONS: $SNDK ( ▲ 4.65% ) $MU ( ▲ 2.59% ) $JOBY ( ▼ 3.71% ) $RBLX ( ▼ 3.79% ) $JCI ( ▲ 0.76% )

Reply